We are in the profession of fund management and not in the business of fund management. We at Fintoo believe in the philosophy of keeping the client’s interest first and doing what is right for the client even if it means a loss of short-term business opportunity. For the past few months, we stayed by this belief and encouraged our clients to refrain from lumpsum investment as we anticipated a sharper correction since the time the Nifty hit upwards of the 18,000 mark. We have come to a point where one can start deploying cash kept on the sidelines in a staggered manner as no one can accurately predict the bottom. That said; let us look at the factors that have taken the bull down to its knees in the equity market.

Table of Content…

- Key Reasons for equity market fall

- Factors that themarket is keeping close eye on

- Key Charts that matters the most

- Important points to keep in mind

Key Reasons for Equity Market fall:

Russia-Ukraine geopolitical tensions

The equity market across the world crashed as Russia invades Ukraine. NATO is holding an emergency session after Baltic nations and Poland, which borders Russia, triggered Article 4. The European Union may discuss personal sanctions against Vladimir Putin. The full scope of the Russian offensive is not yet clear, but U.S. President Joe Biden vowed the United States and its allies would respond decisively to the “unprovoked and unjustified attack.”

Economic sanctions are being placed on Russia. However, a point to note is that Russia benefits immensely from any strength in oil and gold. Russia has an annual average of 10.5 million barrels per day in total liquid fuels production.

If oil goes up by USD 10 per barrel, Russia adds USD 3 billion per month. Russia is the second-largest producer of dry natural gas in 2020 (second to the United States). Russia also produces 6% of the world’s aluminum and 7% of its mined nickel. Russian gold reserves are at 2,300 tones.

Crude at 9-year high

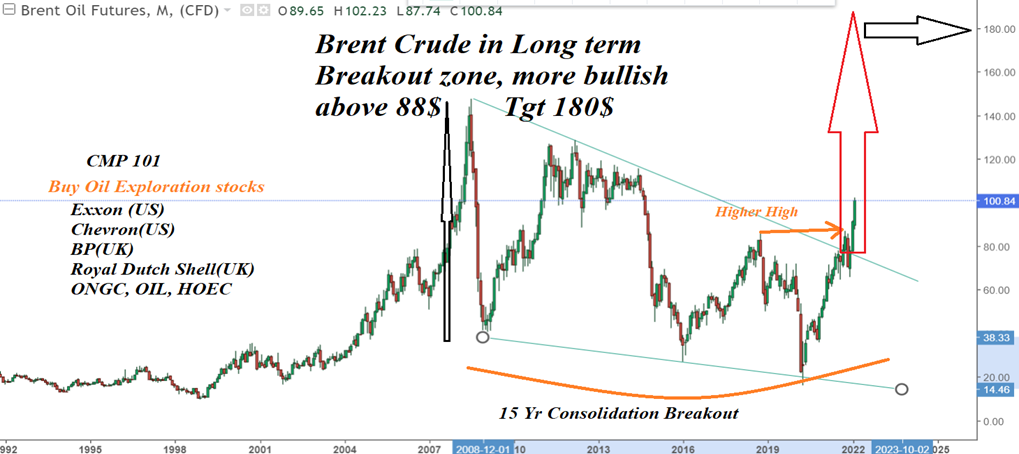

Crude oil prices soared over USD 100 a barrel for the first time since 2014 on fears of a major disruption to global energy supplies. Russia is the world’s second-largest oil producer and is the largest supplier of natural gas to Europe, providing about 35% of the latter’s supply. Brent has been trading within a rising channel since the end of December. The prices have broken out from 15-years of consolidation and if the war scenario continues – the Brent could be heading towards USD 150-180 a barrel.

Relentless selling by the Foreign Institutional Investors (FII) selling

FIIs have sold equities worth Rs 722 billion so far in 2022 as compared to 927 billion in the year 2021. Now that is a substantial figure as FII is anticipating higher global interest rates. Domestic institutional investors (DII) on the other hand have bought equities worth Rs 479 billion so far in 2022 as against Rs 945.7 billion in 2021.

This shows while the FII selling has intensified in the past few months while DII has not been able to match the selling by commensurate buying.

India Inc. to witness margin pressure

High oil prices are inflationary as its impact will be seen on the major raw material prices. Corporate margins are expected to come under pressure in the coming quarter. The management of several corporate has voiced the above concern in the Q3FY22 conference calls. They have suggested that input cost inflation is a serious problem.

Market leaders in Autos, FMCG, Paints, and Consumer Durables space are finding it difficult to pass on the input cost to customers. Smaller B2B like auto ancillaries have seen huge erosion in margins. Big FMCG players are finding it very tough to grow volumes. The slowdown in the rural economy has added to the problem.

The likes of HUL and Dabur are growing volumes at just 2-3% YoY. With this, the EPS estimates could come under downgrades and the earnings multiples could witness a correction.

There are some more factors which the equity markets are keeping a close eye on…

U.S Federal Reserve interest rate action

Until a few days back, the markets were expecting the U.S Federal Reserve to hike interest rates for nine meetings in a row and rapidly rising interest rates were the biggest danger to markets. The popular opinion was that the Fed would raise rates starting March, as it faces the hottest inflation for 40 years.

However, post the Russian invasion of Ukraine and the subsequent risk aversion in the global markets and tightening of financial conditions, traders have cut back on their apprehension of a 50-basis point hike in interest rates in the March meeting. CME’s FedWatch tool showed that traders now see only a 9.5% chance of the US central bank hiking rates by 50 basis points as against 45 percent probability only a week ago.

State election outcome

Developments in the upcoming assembly polls in Uttar Pradesh, Uttarakhand, Goa, Punjab, and Manipur will be closely watched. Polls in these states are being held between February 10 and March 7 in seven phases. The counting of votes and the results will be declared on March 10.

Let us have a look at some of the key charts that matter the most

Nifty 50 index chart paints a gloomy picture

So does the Nifty Midcap 100 and Nifty Smallcap 100 index charts

RBI until now has actively intervened in the forex markets to avoid a surge in USDINR as oil prices rise set for major up move. With Brent Crude trading above USD 100 a barrel, the immediate target for the currency pair is seen at 79.

Gold as an asset class will outperform. Gold has surged above resistance and is at USD 1967, and this should be the catalyst to see the move extend towards the next upside target at USD 1950/65. Beyond here, there is scope for the rally to re-test the August 2020, USD 2050-2075 high.

So, what should the investors do now?

Honestly speaking, there is no instance of a country having benefited from prolonged warfare. Agreed markets will behave like a wild animal but we suspect, any weak rebound attempt will again be swept aside by bears at around Nifty’s 16,700-16,900 zone. So selling on strength will continue to be the preferred strategy. Technically, Nifty’s long-term charts are still painting a bearish picture; aggressive downside risk is seen at 15,551/14,700/13,500 mark. From a chartist standpoint, the technical landscape will improve considerably only above the Nifty 17,000 mark.

If you are a recent entrant in the Euqity market, here are a few important points to keep in mind-

- Sharper the rise, faster the fall.

The fall that we are witnessing is on the expected lines and the investors should not panic. At the same time, one should not mindlessly average your losing positions either.

There is a famous saying- “Everyone has the brainpower to make money in stocks. Not everyone has the stomach.” – Peter Lynch

- Do not be in a hurry to average the stocks.Few stocks can still be expensive if the fundamentals are not in a good shape. But, at the same time, some well-managed fundamentally sound companies do present an opportunity. Be ready to average those but with a staggered approach.

- Continue with your Mutual Fund SIP investments. In fact, during these times, one should introduce a lump sum money to the existing funds if you are a serious long-term investor!